COUNTRY

France

Seats: with metal frames, upholstered, (excluding medical, surgical, dental, veterinary or barber furniture)

Context:

The results provided for this market and product combination is based on the analysis that underpins the outcomes of the study commissioned by SAFI (conducted in 2024). The study is based on Trade Advisory’s Export Market Finder international trade modelling platform that generates product-specific global market intelligence for exporters.

The approach identifies products and markets with export potential and opportunities for export diversification specifically from the global and export context of a particular ‘home market’ (in this instance South Africa), with the main container harbour as main port of exports for the market (in this instance the port of Durban). The approach makes use of a detailed set of various aspects of international trade (e.g. market economics, risk, import demand patterns, concentration, access in terms of tariffs and logistics as well as the home market’s existing as well as new potential export products) to describe the specific country and product combination. This approach is recognised by the World Trade Organisation (WTO) as a trade facilitation tool.

This report contains a summary snapshot of outcomes for the exports of HS940171 to France from the perspective of the home market (South Africa). More technical detail is available on request from Trade Research Advisory.

Angola positioned in terms of overall market opportunities

Evaluation

Realistic Export Opportunity

‘Untapped’ potential for this product into France is estimated at

1.00 Billion ZAR

Import tariff applicable to this product into this market

N/A

The meaning of this…

Key Insights

Market import demand observations for this product:

France’s import demand is relatively large in global terms and has exhibited strong growth in the last 2 years (or which data is available). France exhibits an absolute positive growth trend for this product over the period under consideration, which contributes to confirming this market is a good choice from an import demand perspective.

Competition in the market for this product:

A market’s willingness to trade on a product with a variety of supplying countries is an indication that such a market may be more accessible to new alternative suppliers (such as from South Africa in this instance). Historical import patterns for France specifically demonstrate that France is trading with various alternative supplying countries for this product and hence this fact contributes to a more favourable evaluation of this opportunity from a market access perspective. However, China is a major supplier (at 46.7%) (see Competitors section for more details).

Access to market in terms of relative logistics and tariff costs

In relative terms, for this product, France is relatively accessible from South Africa in terms of the combination of logistics and tariff costs, compared to other markets for the same product. France’s import tariff level for this product from South Africa is set at 0.0% at the time of evaluation (the effective level may change in real-time and always needs to be confirmed before final decision making).

Market growth strategy for this product:

If a company’s strategy is to focus on relatively large and short-term growth markets; France may be an ideal market to enter. If the company is a new entrant to France, there is opportunity to capitalise on the short-term gains in the market’s demand growth in addition to considering how to take market share from existing suppliers to this market. Unless supplying niche type products, France may require larger production capacity in order to fill import demands. This market presents major opportunity in terms of both new shorter-term demand associated with growth as well as potential to target market shares of existing competitors. The growth may not be guaranteed in the longer term. For new exporters France may pose more challenges in terms of penetrating this market due to entrenched competitors.

Existing relationships with target market for this product:

South Africa to date has supplied none or relatively little of France’s import demand specifically for this product which means:

for mature exporters:

If an exporter is mature at exporting this product already, France may be an excellent opportunity to develop for the purposes of market diversification. It will however require some investment in terms of time, effort and costs to develop this market hitherto ‘untapped’ by South Africa’s exporters.

for less mature or new exporters:

If an exporter is mature at exporting this product already, France may be an excellent opportunity to develop for the purposes of market diversification. It will however require some investment in terms of time, effort and costs to develop this market hitherto ‘untapped’ by South Africa’s exporters.

South Africa – France trade for this product HS940171

Trends

The first chart displays South Africa’s export value of the product (if South Africa historically did export this product to France) contrasted relative to the overall trend of this product’s import value (dashed brown line) into France over the last 5 years. The estimated ‘untapped’ potential for France (the solid green bar displayed in first chart) is also shown relative to the target market’s total imports (dashed brown line) as well as existing exports from South Africa(solid blue line). In this instance the estimated ‘untapped’ potential associated with this opportunity is estimated to be 1.00 Billion ZAR. In the second chart the value of existing trade between South Africa and France are shown in finer resolution.

The share of South Africa’s exports of the specific product, relative to total imports of the same product into France from all other trading partners, is demonstrated in the bar chart (solid bars). In this case, at 0.00% (on a 5-year time-weighted basis), South Africa is an existing but relatively small supplier of this product into France, and as such most of the `untapped` potential remains to be pursued by exporters from South Africa.

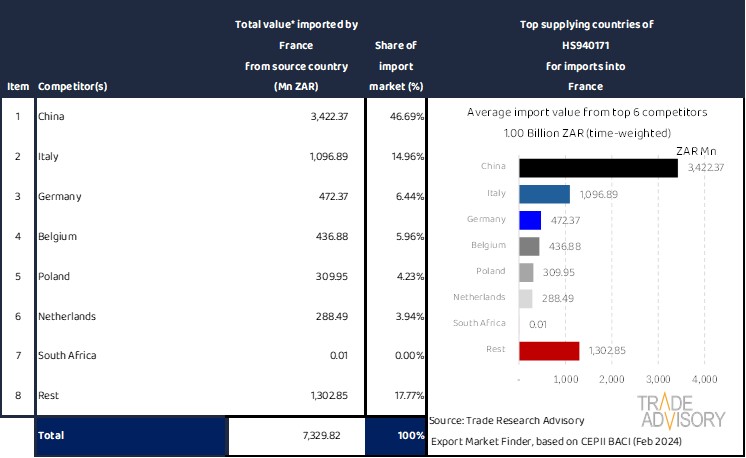

South Africa – France trade for this product HS940171

Competitors

While the preceding analysis indicated that France generally trades with a variety of supplying countries for this product, the following information provides more detail on the potential competing countries that currently are major suppliers of the product into France. South Africa is ranked in position 68 in recent times (out of a total supplier base of 97 countries serving this market’s existing import demand for this particular product, evaluated on a 5-year time-weighted basis). Note that South Africa is always placed in the last position of the chart (before ‘Rest’), irrespective of its actual position as supplier of this product into the target market, while only the main competitors are shown for context. In the event that South Africa does not appear on the chart at all it means there exists no record of recent exports from South Africa to France.