COUNTRY

Serbia

Mattresses: of cellular rubber or plastics, whether or not covered

Context:

The results provided for this market and product combination is based on the analysis that underpins the outcomes of the study commissioned by SAFI (conducted in 2024). The study is based on Trade Advisory’s Export Market Finder international trade modelling platform that generates product-specific global market intelligence for exporters.

The approach identifies products and markets with export potential and opportunities for export diversification specifically from the global and export context of a particular ‘home market’ (in this instance South Africa), with the main container harbour as main port of exports for the market (in this instance the port of Durban). The approach makes use of a detailed set of various aspects of international trade (e.g. market economics, risk, import demand patterns, concentration, access in terms of tariffs and logistics as well as the home market’s existing as well as new potential export products) to describe the specific country and product combination. This approach is recognised by the World Trade Organisation (WTO) as a trade facilitation tool.

This report contains a summary snapshot of outcomes for the exports of HS940421 to Serbia from the perspective of the home market (South Africa). More technical detail is available on request from Trade Research Advisory.

Angola positioned in terms of overall market opportunities

Evaluation

Realistic Export Opportunity

‘Untapped’ potential for this product into Serbia is estimated at

14.28 Million ZAR

Import tariff applicable to this product into this market

8

The meaning of this…

Key Insights

Market import demand observations for this product:

Serbia’s import demand shows that it is growing in both the short and long term, but relative to other global markets it is a small market. Serbia exhibits an absolute positive growth trend for this product over the period under consideration, which contributes to confirming this market is a good choice from an import demand perspective.

Competition in the market for this product:

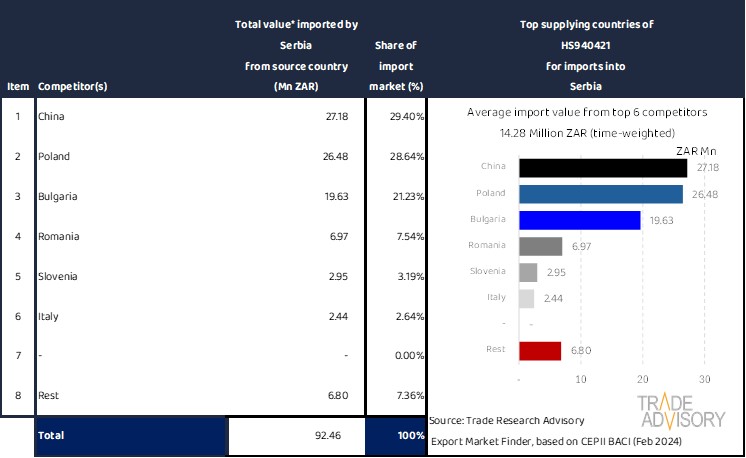

A market’s willingness to trade on a product with a variety of supplying countries is an indication that such a market may be more accessible to new alternative suppliers (such as from South Africa in this instance). Historical import patterns for Serbia specifically demonstrate that Serbia is trading with various alternative supplying countries for this product and hence this fact contributes to a more favourable evaluation of this opportunity from a market access perspective. However, China is a significant supplier (at 29.4%), followed by Poland (at 28.6%) and Bulgaria (at 21.2%) (see Competitors section for more details).

Access to market in terms of relative logistics and tariff costs

In relative terms, for this product, Serbia is relatively accessible from South Africa in terms of the combination of logistics and tariff costs, compared to other markets for the same product. Serbia’s import tariff level for this product from South Africa is not zero, but set at a relatively low rate of 8.0% at the time of evaluation (the effective level may change in real-time and always needs to be confirmed before final decision making).

Market growth strategy for this product:

If a company’s strategy is to focus on relatively small but growing markets; Serbia may be an ideal market to enter, understanding that larger volumes may only arise in future. This market may pose opportunity for smaller volume export producers.

Existing relationships with target market for this product:

South Africa to date has supplied none or relatively little of Serbia’s import demand specifically for this product which means:

for mature exporters:

If an exporter is mature at exporting this product already, Serbia may be an excellent opportunity to develop for the purposes of market diversification. It will however require some investment in terms of time, effort and costs to develop this market hitherto ‘untapped’ by South Africa’s exporters.

for less mature or new exporters:

If an exporter is mature at exporting this product already, Serbia may be an excellent opportunity to develop for the purposes of market diversification. It will however require some investment in terms of time, effort and costs to develop this market hitherto ‘untapped’ by South Africa’s exporters.

South Africa – Serbia trade for this product HS940421

Trends

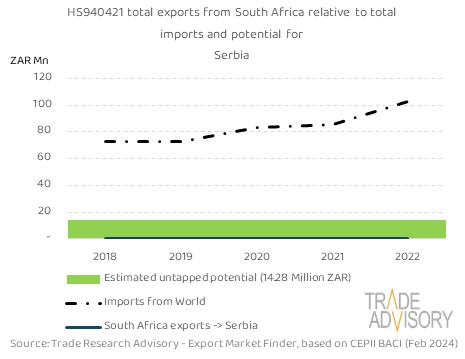

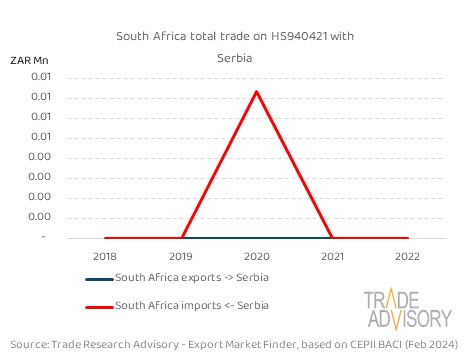

The first chart displays South Africa’s export value of the product (if South Africa historically did export this product to Serbia) contrasted relative to the overall trend of this product’s import value (dashed brown line) into Serbia over the last 5 years. The estimated ‘untapped’ potential for Serbia (the solid green bar displayed in first chart) is also shown relative to the target market’s total imports (dashed brown line) as well as existing exports from South Africa(solid blue line). In this instance the estimated ‘untapped’ potential associated with this opportunity is estimated to be 14.28 Million ZAR. In the second chart the value of existing trade between South Africa and Serbia are shown in finer resolution.

The share of South Africa’s exports of the specific product, relative to total imports of the same product into Serbia from all other trading partners, is demonstrated in the bar chart (solid bars). South Africa supplies none of Serbia’s total imports of this product (on a 5-year time-weighted basis). In this case, since South Africa is not a major existing supplier of this product into Serbia, the opportunity to enter this market exists and most of the `untapped` potential market remains to be targeted by South Africa’s exporters.

South Africa – Serbia trade for this product HS940421

Competitors

While the preceding analysis indicated that Serbia generally trades with a variety of supplying countries for this product, the following information provides more detail on the potential competing countries that currently are major suppliers of the product into Serbia. South Africa, in recent times, does not appear in the existing supplier base of 43 countries serving this market’s existing import demand for this particular product (evaluated on a 5-year time-weighted basis). Note that South Africa is always placed in the last position of the chart (before ‘Rest’), irrespective of its actual position as supplier of this product into the target market, while only the main competitors are shown for context.